1.Exiting Investment opportunity

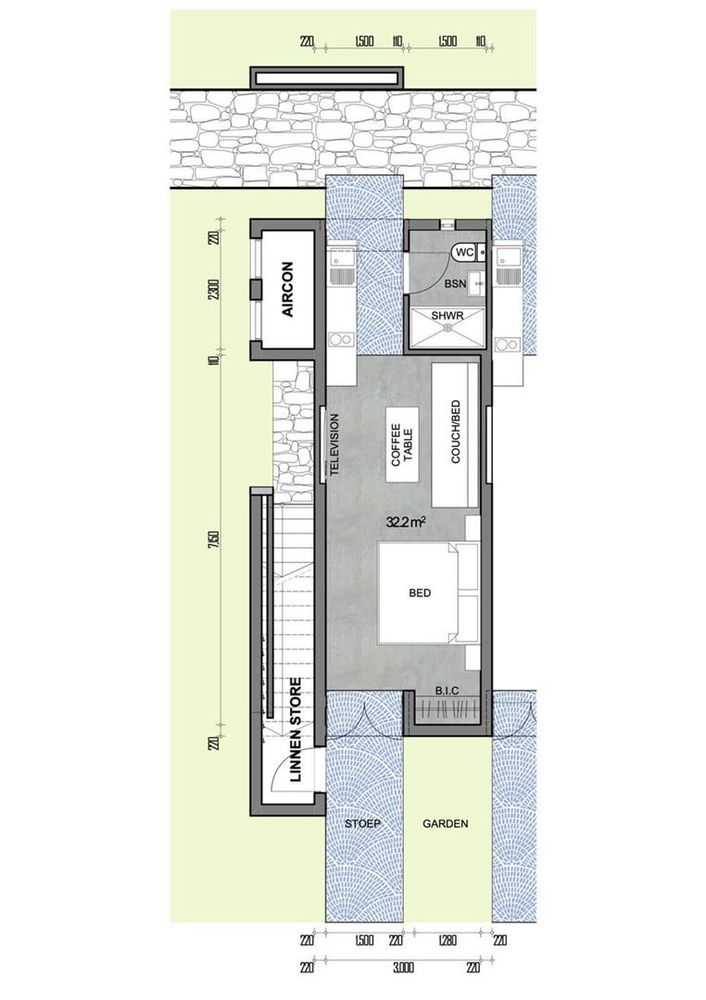

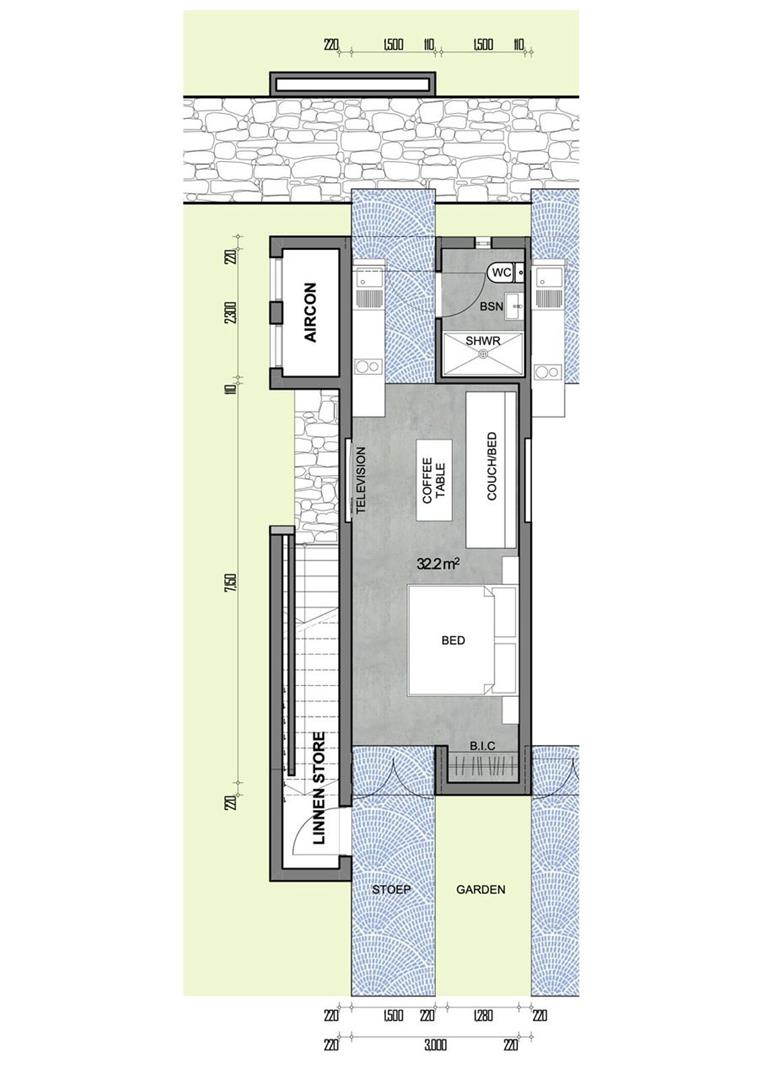

a. Self catering Hotel within a town lodge style development

b. 82 Units

i.Totally furnished

ii.Focus on family friendly resort

2.Benefits

a. Low investment vs. high return

b. 35% occupancy = 10% return

c. 65% occupancy = 24% return

d. 75% occupancy = 26% return

e. Total pool income is shared to the owners

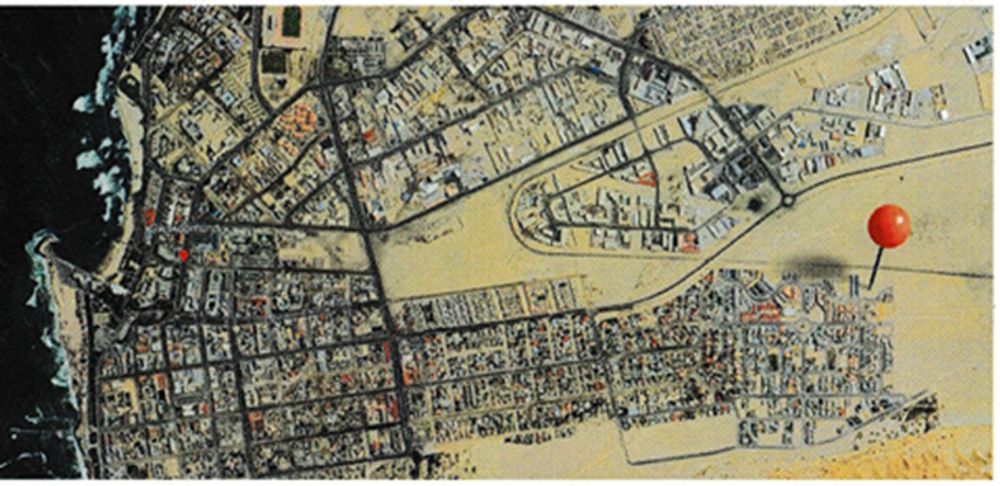

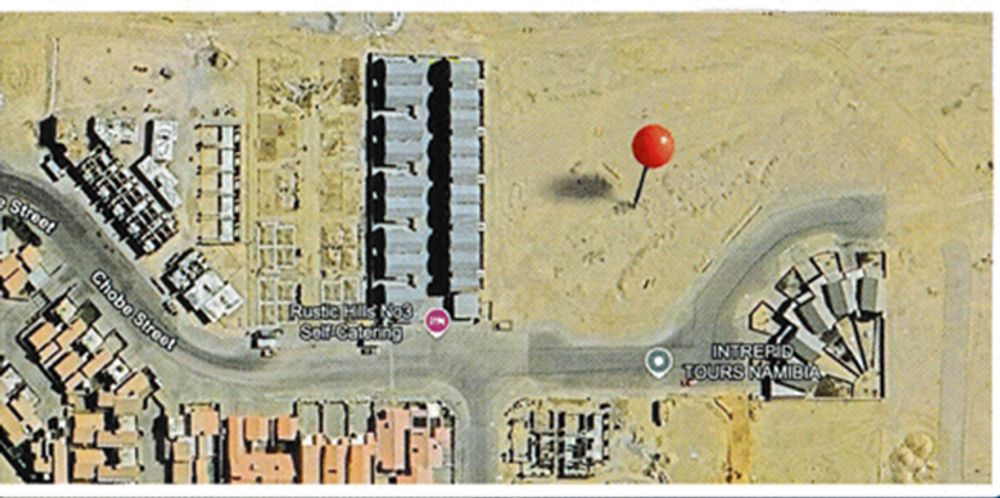

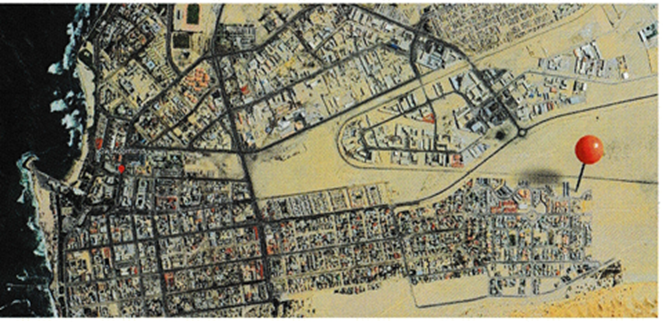

3.Swakopmund market

a. Projections align with conservative (35%), average (65%) and maximum (75%) occupancy scenarios,

b. Reflecting local hospitality trends

4.Options

a. Unit only – N$1,480,000 – Earns income from accomodation only

i. Lower entry cost, attracting – 50% of investors

ii. Return on investment – 10% to 26%

iii. driven by reliable accommodation income

b.Full investment – N$1,680,000 – Income from accommodation and other amenities

i. Higher return on investment – 14% to 32%,

ii. Leveraging diversified income from amenities

1. Bar/Restaurant/Conference facilities

iii. Ideal for investors seeking broader revenue streams

c.Passive income

i. Professional management by Perfect Stay ensures seamless operation

5.Process

a. Developer plans to sell 50% by January 2026

b. Buyer signs “Offer to purchase”

c. Buyer pays non-refundable N$30,000 deposit within 7 days

d. Buyer provides guarantees for the balance within 30 days

e. Plan to complete 2026

6.Levies appr.N$4,500

a. All replacements/repairs in the units “financed from the levies pool”

VAT excluded (if applicable)

TRANSFER Costs included - only should buyer be a natural person.